Key Features

-

Configurable workflows

-

Simplified paperwork

-

Borrower scoring and project scoring

-

Automated Scoring Decisions

-

Automated Approvals

-

Secondary loan trading

-

Trust accounts

-

Task list for user roles

-

Divided task flows

-

Automated tasking and progress tracking

-

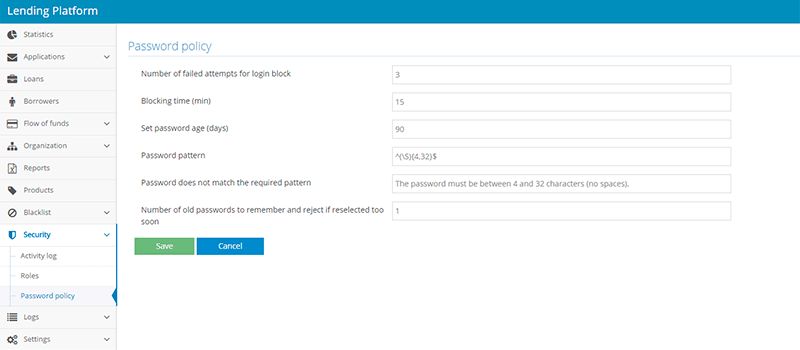

Regulatory compliance

-

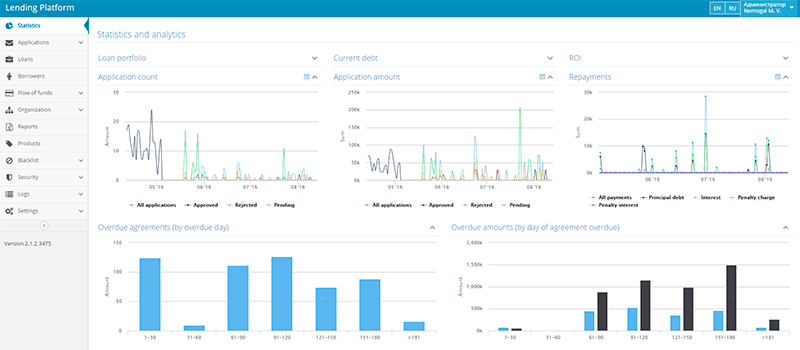

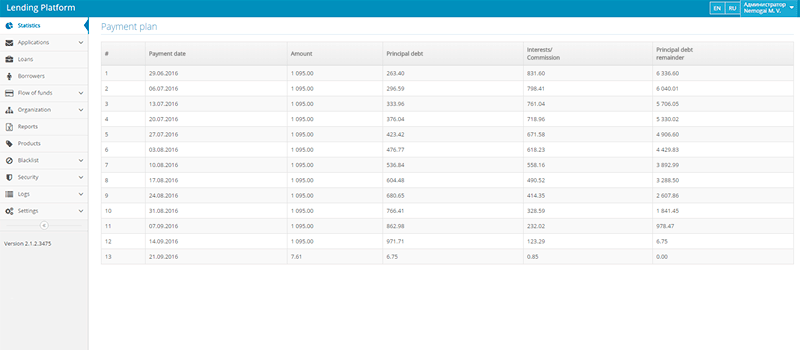

Payment schedule tracking

-

One-click check-and- sell transactions

-

Automatic trading

-

Off-platform document signing

-

Flexible interest rate and other parameters

-

Initial borrower background checks

-

Further borrower and document checks

-

Automatic project payment distribution

-

Integration with invoicing party/borrower accounting system for invoice transaction data exchange