HiEnd Systems software gives peer-to-peer lending businesses a competitive edge by allowing them to manage any aspect of consumer or business marketplace lending through a flexible technology solution.

It sources and fractionalizes loans, brings in prospective borrowers, evaluates risks, produces all the documentation necessary to support lending deals, and manages the entire loan servicing process. Tap into powerful customisation options to build valuable client experience and protect your platform brand. HiEnd Systems P2P lending solution can be set to go in a few months’ time matching 100% of key business requirements.

P2P Lending Challenges vs. Key Solution Advantages

See how HiEnd Systems P2P lending solution can help you turn industry challenges into business advantages.

time to market

Going live faster and keeping up with competitors’ offerings.

Modular architecture

The modular structure provides flexibility and robustness. Start with a minimum viable product (MVP) in 2 to 5 months and expand.

All-encompassing business software

Creating a comprehensive software system that will manage a multitude of P2P lending workflows in a seamless and cost-effective environment.

Heavy-duty multitasking

The solution encompasses all critical activities needed to launch and run a profitable P2P platform. Stay on top of your business and comply with changing regulations and processes.

Customer acquisition

Retaining existing and attracting new borrowers and investors, while bringing down customer acquisition costs.

Automated credit decisioning and great customer experience

The white-labelled front end delivers compelling user experience. The marketing module will help in sourcing more new clients from direct mail campaigns and social media advertising. Additionally, automated underwriting will keep down operating costs.

Fraud prevention

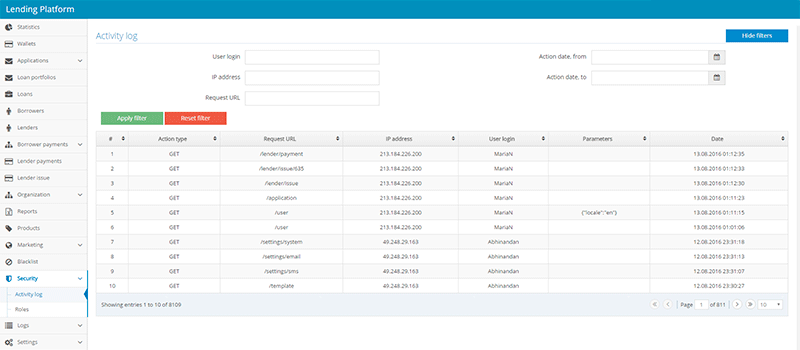

Developing a reliable risk monitoring mechanism to help avoid malpractice and platform fraud.

Transparency and risk monitoring

The KYC module allows for unlimited integrations with client verification and scoring services. Extensive scoring and reporting capabilities help in protecting investors and maintaining trust. Take informed underwriting decisions and make sure borrowers meet the terms of their lending deals.Modules

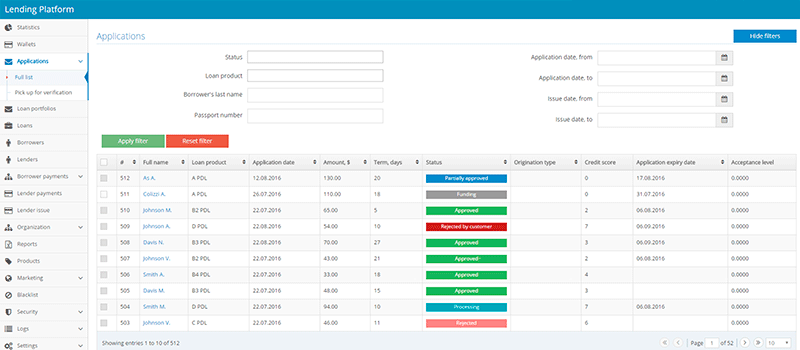

CRM

The CRM module forms the backbone of the platform and uses web services for advantages of accountability. Control and consolidate all lender and borrower data, get a full-blown overview of lending project details, borrower/lender history, documents, communication and transactions. Interact with P2P platform users meaningfully and at the right times.

Calculation engine

Set up borrower payment schedules and track payments to each of the platform lenders. Automatically adjust and recalculate lender-specific payment streams based on overall borrower payment pattern and payment distribution rules. Updated payment schedules are delivered automatically and are available for viewing in lender/borrower personal accounts.

Product engine

Create and customise a range of loan products. Select from multiple fixed and flexible parameters for precise tuning. Declare your specialisation in certain niches or focus on product differentiation.

Risk evaluation and KYC

Analyse multiple data points to make accurate, reliable and fast credit risk decisions across the customer lifecycle. Have your own risk assessment algorithm implemented or integrate with third-party scoring solution providers.

Supercreditor functionality

Become a super lender for borrowers on your platform. Grab the best projects and invest for profit or never let any of the projects go unfunded. The owner of the platform can perform the ultimate lending task and provide full funding or add to the existing pool of funds to complete any of the lending projects.

Matching engine

The matching engine automatically matches lenders to borrowers while taking into account borrower-specific and lender-specific settings. Matching rules are fully customizable and normally reflect borrower risk parameters, loan size, maximum lender bid size and other rules, which uniquely define each P2P solution.

Commissions

Stream all payment transactions through your platform and earn commission payments. The commission engine will automatically calculate commission amounts and either adjust the corresponding payment immediately, or generate the commission report for those cases when commission settlement occurs outside the platform.

Payments and money transfers

HiEnd Systems P2P lending solution has all the features and functions you will need to run a scalable money transfer and payment service. Track accounts and balances of each transaction party, create an effective money distribution chain, and rest assured you are compliant with anti-money laundering (AML) and know your customer (KYC) regulations.

Notifications

Set up and send custom email alerts or text messages to borrowers and lenders.

Statistics and data visualisation

Collect detailed statistics and leverage visualisation tools to get quick overviews.

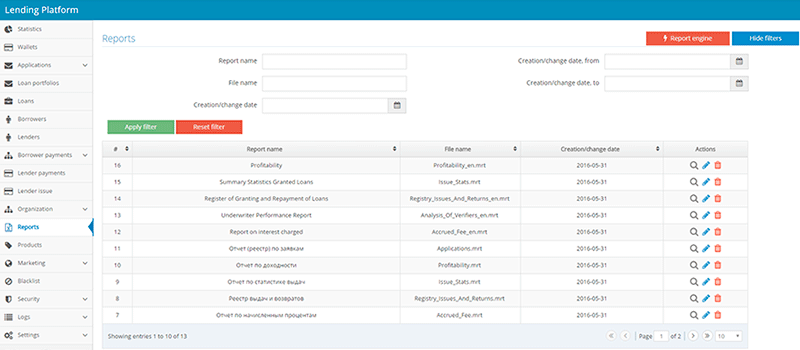

Monitoring and reporting

Choose from a set of standard pre-built reports and time-saving dashboards, or run the report builder and create unlimited custom reports using hundreds of variables. Export data to tens of formats, including Excel, Word, PDF, TXT and others. Print and mail reports in one click.

Digital marketing

The digital marketing module combines all essential marketing tools into one simple solution. Attract and retain borrowers and investors, build brand awareness and reputation, track the results of direct marketing campaigns and calculate customer acquisition cost (CAC).

Electronic wallets

Keep the money on the platform by streaming all the lending and repayment transactions through platform wallets of both counterparties. The system keeps track of all wallet balances, freezes bid amounts in investors’ wallets and transfers money to borrowers’ wallets once the project is fully funded. The interest revenue of each investor accumulates in their wallet and can be reinvested again never leaving the platform.

Document and template management

HiEnd Systems P2P lending solution has a powerful workflow engine that automates all relevant paperwork. This means shorter turnaround time and cost effective business processing.

Although just a decade old, the P2P lending industry no longer seems quite so unconventional.

Although just a decade old, the P2P lending industry no longer seems quite so unconventional.

It is coming of age and turning into a large-scale, mature and stable market, which brings real benefit to borrowers and investors. PwC projects that the world’s P2P lending market will be growing to reach $150 billion or higher by the year 2025.

How to start

-

1Contact us

-

2Schedule demo

-

3Define your scope

-

4Get proposal

-

Start!