Modules

CRM

The CRM module sits in the heart of the platform and handles major customer and loan management processes. Manage and track your customers, their loans and payments. See a complete overview of customer details, history, documents, communication and payments. Instantly call, text or email your customers.

Credit scoring

Build your own decision making process using various customer data sources or integrate with third-party scoring solution providers. Adjust and train the system to make correct decisions once sufficient data is collected.

Document and template management

Easily manage offers, contracts, loan agreements, notes and other system documents. Attach scanned documents and photos by grabbing them directly from a scanner or camera.

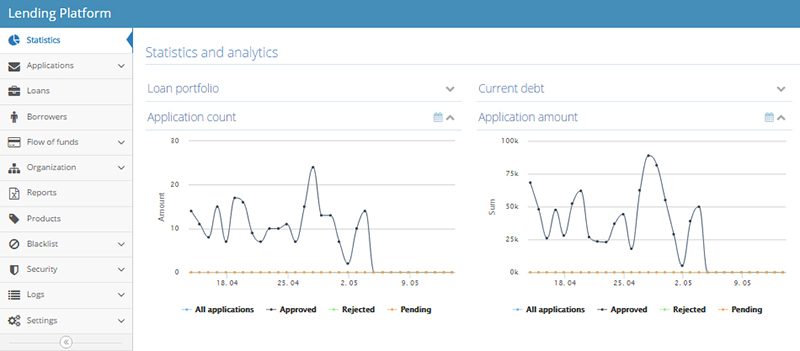

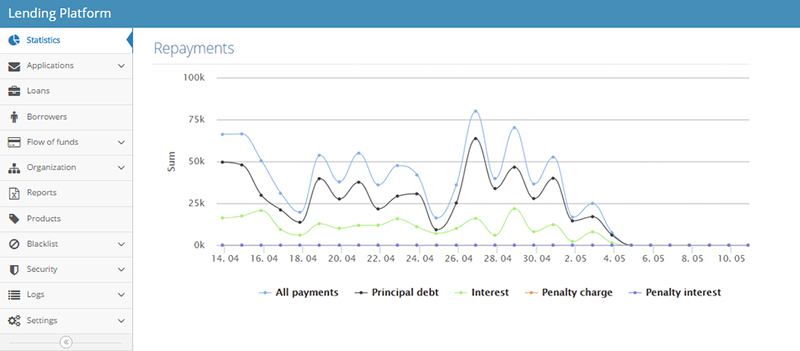

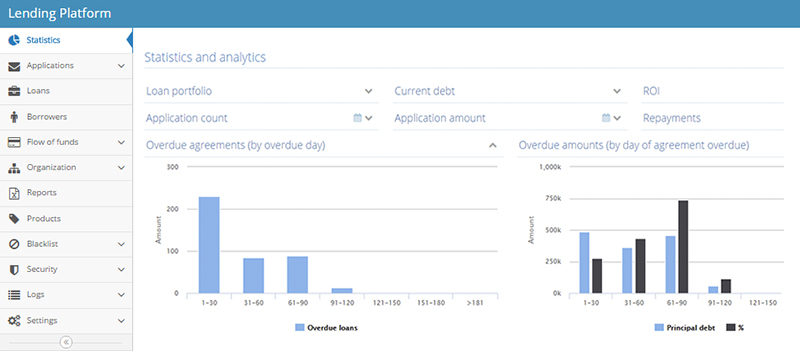

Statistics and visualisation

Get up-to- date statistics and visualise them on the dashboard.

Notification centre

Send automatic/scheduled emails, text or personal platform messages to customers. Notifications can be anchored to a specific event in a customer’s credit history.

Reporting engine

Use a predefined set of detailed user-friendly reports, edit, add your customised reports and export data to tens of formats, including Excel, Word, PDF, TXT and others.

Payments and money transfer

Send money to your customers’ bank accounts, debit cards, PayPal accounts, electronic wallets, etc. Monitor the result and automatically initiate loan calculations as appropriate.

Online marketing

Track the results of your lead generation campaigns, including CPC/CPA advertising and partnership networks.

Built-in product engine

Define your own loan products – allow or freeze loan extension and rollover, set minimal payments, fines and tens of other parameters. The product engine allows you to use fixed and flexible parameters. A predefined set of parameters is specified for static credit products. Flexible parameters are generated during the pricing process and are used for dynamic credit products.

Security settings and preferences

Manage user permissions using role-based access control features. Define fine-grained password policies. Build rules to allow or block access by device ID. Easily track and monitor user activity across the platform.