-

HiEnd Systems POS lending system enables loan providers to expand their business to new frontiers with retail lending.

-

The system is well-suited for both real POSs, as in the case of brick-and- mortar stores, and virtual POSs,as in the case of electronic retailers that sell goods and services over the phone or online. As a web-based solution, it can be hosted on-premises or in the cloud, and accessed from almost anywhere using almost any web enabled device.

HiEnd Systems POS lending software has been designed to deliver seamless client experience at the front end. It eases the burden of IT for your retail partners and gives consumers instant access to the tools they need to apply for a loan, when shopping for big-ticket items or services.

“Your organisation’s ability to capture a growing share of the retail market depends on your ability to deliver a superior customer experience that takes advantage of leading-edge technologies.”

POS Lending Industry Challenges vs. Key Solution Advantages

See how HiEnd Systems P2P lending solution can help you turn industry challenges into business advantages.

Staff keeping expenses

Keeping a dedicated team of employees responsible for training sales assistants at the POS to work with the loan origination system. Keeping sales assistants interested in sending loan applications to your organisation.

Highest degree of automation with simplified intuitive interface

Replace ad hoc manual process with automated workflows, save on staff costs, and decrease the bureaucratic workload. Have a loan application filled in one time and automatically sent to all relevant partner loan organisations.

Update monitoring

Standalone software for loan origination needs to be regularly checked for updates and timely updated.

Further support and capability for making in-house improvements

Take advantage of HiEnd Systems technical support services or make your own extensions and upgrades, as your business needs grow.

Advertising expenses

Creating expensive promotional materials to be placed at the POS and running joint promotional campaigns.

Compelling customer service experience

Deliver a superior lending experience on every loan you do. Start a long-term relationship with customers acquired through the POS channel, and have repeat business with them.

Dealing with competition

Fighting competitors’ efforts to decrease the flow of loan applications in favour of your organisation.

Diversified loan services

The modular architecture lets you easily expand your existing lending solution. Reduce concentration risk and increase profitability by expanding your business to related areas. Move marketplace lending to POS or broaden your range of consumer services – all on one software platform.Modules

CRM

Accelerate your lending pipeline by managing and tracking borrowers and merchandising companies. Compile and analyse information from different communication channels, including a company’s website, telephone, email, live chat, marketing materials, social media and more. Assess borrowers’ credit capacity and reach out to them to offer further financial services.

Retail partner management

Create and manage any number of partner points of sale and credit representatives to offer your loan products. Configure partner profiles, set up fully customisable workflow rules and features, and get complete insight into partner activities.

Product and pricing engine

Focus on unmet consumer needs and offer flexible financing options at the point of sale. Configure and launch new types of loan products within minutes. Manage all your loan products in one place, with the ability to add retail chains, independent retailers, and online shops. Edit, copy, activate, inactivate, or delete existing loan products.

Template-based document management

With HiEnd Systems POS lending solution, you can quickly collect information about the potential borrower and complete all relevant paperwork. Select document templates from a robust library of loan documents. Create customised loan applications, customer notices, and more without having to copy and paste anything. Attach ID scans and photos by grabbing them directly from a scanner or camera. Review documents and send them for e-signature.

Credit scoring and underwriting

Accurate assessment of customers’ credit standing will help to reduce credit risk on new customer signup, while automated loan decisioning will minimise operating expenses. Have your own scoring algorithm rolled out or integrate with third-party risk management products and services.

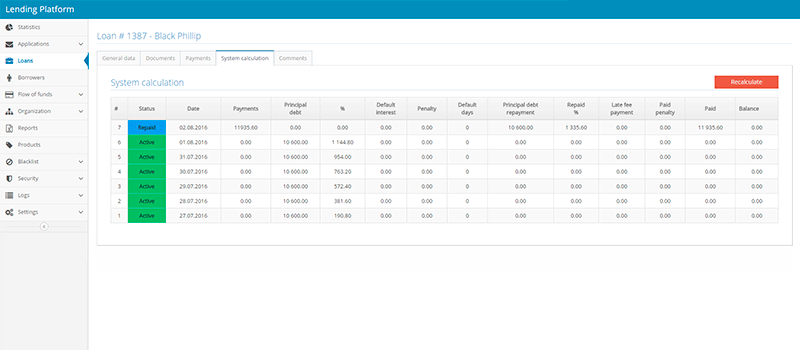

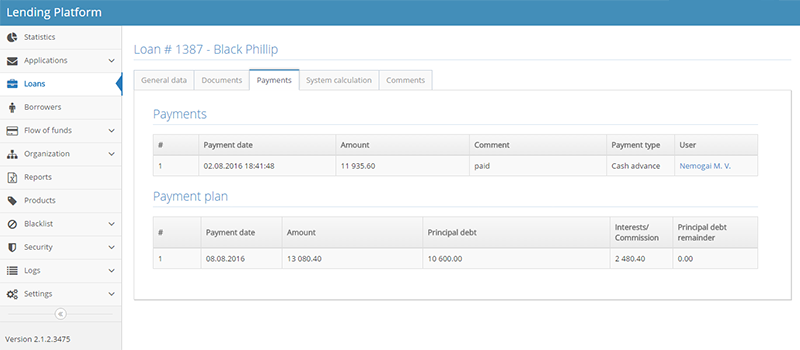

Payments and money transfer

Consolidate all payment workflows into one central hub for significant cost savings, enhanced quality of service and greater operational efficiency. Generate outgoing payments and receive incoming payments by e-money, bank transfer, card or cash with minimal user intervention and high security.

Reporting engine

Sum up and analyse your data with reports, which you can view, share, collaborate on, export and print. Use standard reports and dashboards for quick results or get exactly what you want by customising standard reports and building custom reports from scratch. Export data to tens of formats, including Excel, Word, PDF, TXT and others.

Statistics and data visualisation

Leverage intuitive tools for expressing data through graphs, charts and maps.

Notifications

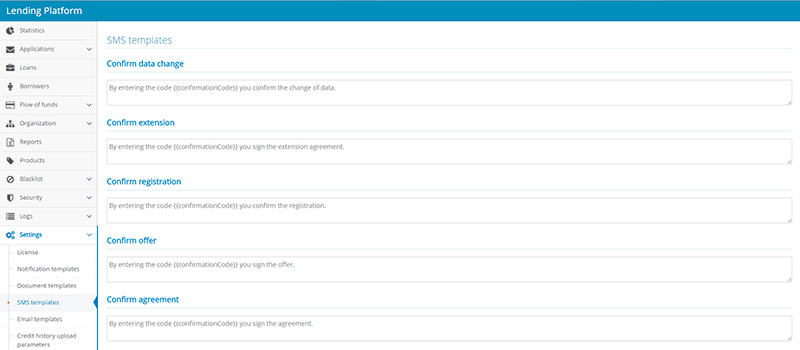

Set up, schedule, personalize, and send email or text notifications to retail partners and borrowers.

Security settings and preferences

Role-based access control ensures that only authorized users have access to customers’ personal details and sensitive system functions. Other security features include password policy configuration, access restriction by device ID, and detailed user activity audit logs.

Customer convenience will continue to drive the need to streamline and simplify the lending process at the point of sale. Take your chance to seize an untapped multibillion loan opportunity with HiEnd Systems software for POS lending.

How to start

-

1Contact us

-

2Schedule demo

-

3Define your scope

-

4Get proposal

-

Start!